Becker Milk Company - microcap, profitable and asset sales (liquidation) at 0.70x P/TBV

The end of an incredible story about a former convenience store giant in Ontario. This last run could give a +15% IRR, all backed by 26% cash and $ATD.TO shares, plus 32mm assets.

Disclaimer, I am a shareholder of Becker Milk Company.

Becker's is a Canadian chain of independent convenience stores selling products of Alimentation Couche-Tard company. The original Becker Milk Company was founded in 1957 in Toronto, Ontario. The chain grew from 5 to 750 stores and was sold in 2006 to Alimentation Couche-Tard. The company converted the company-owned stores to Mac's Milk and later to Circle K, leaving a remnant of affiliate Becker's stores. Starting in 2013, Alimentation Couche-Tard began expanding the affiliate program.1

Investment thesis

This investment is considered a liquidation opportunity.

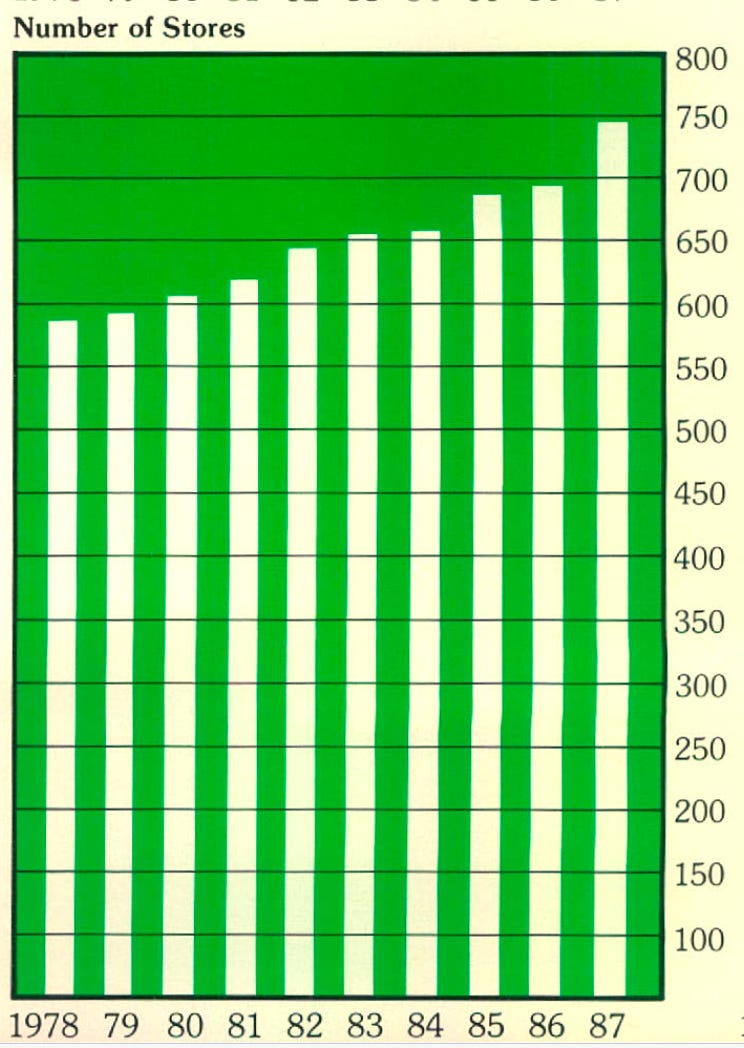

For more than 5 years, the two founders of Becker Milk Company, who are over 70 years old, have been selling several of their land and buildings. In 2011, he owned more than 67 properties. After 4 years of accelerating sales, we reached 38 properties.

Here is a timeline of sales

2018 (54 → 51)

2019 (51 → 48)

2020 (48 → 44)

2023 (43 → 39)

2024 (39 → 38)

The management is no longer so young and it seems clear that they have increased asset sales. Sell the other properties and return all capital to shareholders, how much would that give us?

Starting with the balance sheet

At the current price of $23 million, what do we have for that price?

The first thing we see is that we don’t have any debt. It’s a very rare situation for a REIT type of business. The mere fact of taking leverage could increase our ROE from 6% to +9%.

We have 32 million commercial buildings in southern Ontario, which are mostly single stores and a few multi-store plazas. The cap-rate used is 6.50%. Or 30 million at 7% cap-rate.

Then, what does the long term investment line hide?

We own 32,592 shares of Couche-Tard ($ATD.TO). No wonder they invest in Couche-Tard.

Nearly $3 million in short-term investments are GIC and Canadian government bonds, all guaranteed at rates of approximately 4.75%.

We have more than 6 million in cash and investment that can be sold at any time, which represents about 27% of the market cap.

The management (Bazos, Pottow and Panos family) owns 30% of Common Shares.

How long does it take to sell the buildings?

The age of the CEO (Geoffrey Pottow) +84 is a major factor in this thesis. Since 2020, they have proven that they are selling. We should receive a dividend of $0.80 per year, plus special dividends every year at the end of the year, with the profit from real estate sales, GIC, Bonds and $ATD.TO shares.

If the buildings are sold regularly over a period of 5 to 6 years, here is a quick calculation.

This is an attractive return if we take into account that the downside is close to 0% for a yield of 6% to 18% for the next 5-6 years? It is rare to find this type of return over a long period with tangible guarantees on the TSX.

This seems like a good opportunity to hide in an overpriced North American market and wait for better opportunities with higher returns.

🚩 Warning

It seems to me that the administrative expenses in the income statement seem very high at 1.30 million. The salary of the board members, CEO, and CFO is approximately $600,000 total. If we add the fees from TSX ($10,000), the transfer agency ($9,000), SEDAR ($6,000), Audit ($110,000). We have approximately $135,000 in expenses for a total of $735,000 in SG&A.

We also have legal and office fees, but I can’t understand how we can spend $1.30 million on administration costs for this company.

Buildings

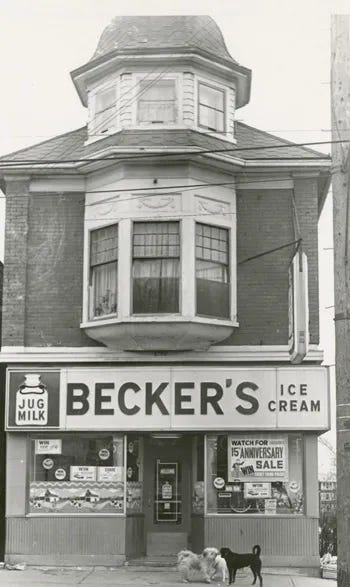

Here are some photos of places to give you an idea of the quality of their building.

If you would like to learn more, here is a brief summary

Where It All Began

In 1957, the Becker Milk Company Limited opened their first five Becker’s convenience stores with the vision to become an established and recognized convenience store brand in Ontario.

Today, Becker’s remains a favourite stop for Ontario residents with a resurgence plan to refresh the brand and make Becker’s better than ever. They are set for success with a legacy of innovation and customer satisfaction.

Founded by Frank Bazos, Becker’s was one of the first companies to innovate the way corner stores had operated for years. The Bazos family were already established, successful entrepreneurs in the Toronto area, when they changed the way Canadians would purchase milk forever— in one-gallon returnable jugs. Becker’s was also the first Canadian convenience store chain that was open seven-days-a-week for fourteen-hours-a-day. Customers had long waited for the convenience of shopping after hours and were willing to pay a premium for it.

Over the next few decades, the Becker’s chain would become a multi-million-dollar brand with

500 stores, in 120 cities and towns throughout Ontario. Becker’s was known for its dairy line including jug milk and chocolate milk. In fact, their chocolate milk was recognized for using 3 per cent milk creating a thicker and smoother taste. Other signature Becker’s products that customers enjoyed were egg nog, jungle juice, Becker’s bread, ice cream and their delicious popsicles.

Their stores were also popular because they maintained the highest standards of quality, cleanliness and fast service.

Much to our beginnings today Becker’s is driven by our parent company Couche-Tard and our family is larger than ever and with this massive family we still believe Becker’s is a brand that brings memories of happiness.

source2

Annual report - 1987

-Max

https://en.wikipedia.org/wiki/Becker's

http://mybeckers.ca/where-it-began