Update on some special situation

I am always looking for “special situation” opportunities with a high IRR (25-50%). In a market (USA & Canada) that I find risky, I find it even more interesting.

Here’s a quick summary of some good 2025 opportunities that I think is picking up money from the ground that nobody wants. Prices or situations change quickly and many may no longer be available at a good price. Be careful.

$SRES.TO - Sun Residential Real Estate Investment Trust

Sun Residential REIT Announces Plans to Sell Its Properties and to Wind-up and Terminate Sun Residential REIT

Details of Sale Transactions

Evergreen at Southwood is being sold to Westdale Galesi Partners, LLC, the current owner of the remaining 49% interest in Evergreen at Southwood. Under the Purchase Agreement for Evergreen at Southwood, signed April 1, 2025, Westdale Galesi Partners, LLC has agreed to acquire Sun's 51% of the interests in Westdale Evergreen Southwood LLC, the owner of Evergreen at Southwood, for US$14,055,600, an amount in excess of the fair market value of Sun's interest in Evergreen at Southwood as included in the audited consolidated financial statements of Sun for the year ended December 31, 2024. The mortgage loan for Evergreen at Southwood will remain with Westdale Evergreen Southwood LLC.

Tudor is being sold to 4815 Tudor Drive, LLC. Under the Purchase Agreement for Tudor, signed April 1, 2025, 4815 Tudor Drive, LLC has agreed to acquire Tudor for US$1,250,000, an amount consistent with recent broker opinions of value obtained by Sun. Tudor is mortgage free and its renovation is expected to be completed before its sale closes.

ALLK 0.00%↑ - Allakos Inc.

Allakos to Be Acquired by Concentra Biosciences for $0.33 per Share

Under the merger agreement, a Concentra subsidiary will start a tender offer to acquire all outstanding shares of Allakos for $0.33 per share in cash by April 15.

The transaction is expected to close in May, Allakos said.

$SXI.TO - Synex Renewable Energy Corporation

Synex Renewable Energy Corporation Announces Agreement to be Acquired by Sitka Power Inc. for C$2.40 Per Share in Cash

All of the directors and officers of the Company, who collectively own approximately 67% of the outstanding Company Shares, have entered into voting and support agreements pursuant to which they have agreed to vote their Company Shares in favor of the Transaction.

$NVI.TO / $NVRVF - Novra Technologies Inc.

Significant Event

On September 10, 2024, Novra Technologies Inc. (“Novra”) entered into a binding non-brokered Convertible Loan Agreement in the aggregate of $12.3 million with a US-based private investment group ("Lender"). Under this Convertible Loan agreement, Lender agreed to loan Novra $12.3 million for a term of up to two years at a fixed interest rate of 1.0% per annum. At its sole discretion, the Lender may elect to convert the outstanding principal balance of the Loan, at any time during the term, to Novra common shares at a rate of $0.34 per share. At the end of the term, should the Lender not convert, Novra has the right to force the conversion of the outstanding Loan principal to shares at the same fixed rate, or to repay the loan. The Lender is an arms-length third party. There is no finders fee associated with this transaction. The funds will be used to pay most of Novra's liabilities, for working capital as Novra continues to invest in R&D, to continue enhancing our current product lines, and for expansion into new markets with new innovating products and services. If fully converted, this would result in the issuance of 36,053,000 common shares of Novra at $0.34. This proposed private placement is subject to the approval of TSX Venture Exchange and may also require approval by Novra's shareholders. These approvals have not yet been received, and no funds have been received under the agreement as of November 29, 2024. As the Company has not yet received any funds under this agreement, the reader should refrain from placing undue reliance on the anticipated closing of this potential transaction, either as described or at all.

Total Insider : 18% (15.40% CEO/Fondateur)

Principal Products

Satellite receivers (DVB and ATSC)

NovraLink Digital Signage platform

STAR and ProAudio lines of professional audio products

MISTiQ hybrid satellite/terrestrial/cloud distribution networks

Datacast XD content distribution network (file broadcast) software

CypherCast conditional access system

Sanjay Patel : CEO de Snaps Holding

Sanjay Patel, Founder & CEO of Lilikoi said, “In DEV IT, we find a perfect blend of technical skills with service capabilities to deploy our solutions in North America and other developed geographies. We are excited to share our vision, of being unique AI enabled IoT wireless ecosystem provider, with the promoters of DEV IT and leverage their ITeS capabilities to provide efficient and expeditious solutions to our target clientele.”

This transaction envisages a transformation of DEV IT from a conventional software development and ITeS company into a diversified, IoT / AI driven software engineering company meeting the next-gen turnkey system integration requirements of the global clientele.

As part of the agreement signed with Lilikoi, there shall be no material changes to the management framework of DEV IT and the current promoters and senior management of DEV IT shall retain their managerial and Board positions. This strategic acquisition will ensure benefits to all four-dimensions of the company – shareholders, employees, customers & aligned stakeholders and promoters.

$SEV.TO - Spectra7 Microsystems Inc.

Parade Technologies Acquires Spectra7 Majority Assets to Enhance High-Speed Data Transmission Capabilities and Boost Connectivity Market Opportunities

Management information circular - English.pdf

***UPDATE April 16th 2025

The cash portion of the Special Distribution is estimated to be approximately US$1,070,000 (approximately CDN$1,537,590), or approximately US$0.0039 per share based on the share information below, and is expected to be made within two weeks after Closing. The reduction of the cash portion of the Special Distribution compared to prior disclosure by the Company is as a result of updated employee compensation obligations and governance, maintenance and wind-down costs amongst the Company's international operations. Assuming the Escrow Amount is released in full, the distribution to CVR holders is estimated to be US$1,800,000 (approximately CDN$2,586,600) or approximately US$0.0065 per share, and is expected to be made shortly following the Escrow Release Date.

$FUNFF - FansUnite Entertainment Inc.

You can read more here:

THTX 0.00%↑ / $TH.TO - Theratechnologies Inc.

It is a little late for new investor but this is another busted-bioparhma.

We have 2 potential buyers, one is already in exclusive negotiation for several months and a 2nd who sent an offer last week for a price of USD3.50 to USD4.50$. The offer seems to be very high which values Theratechnologies has more than 15x EBITDA which makes me think of a bluff to make the negotiation of the first offer fail.

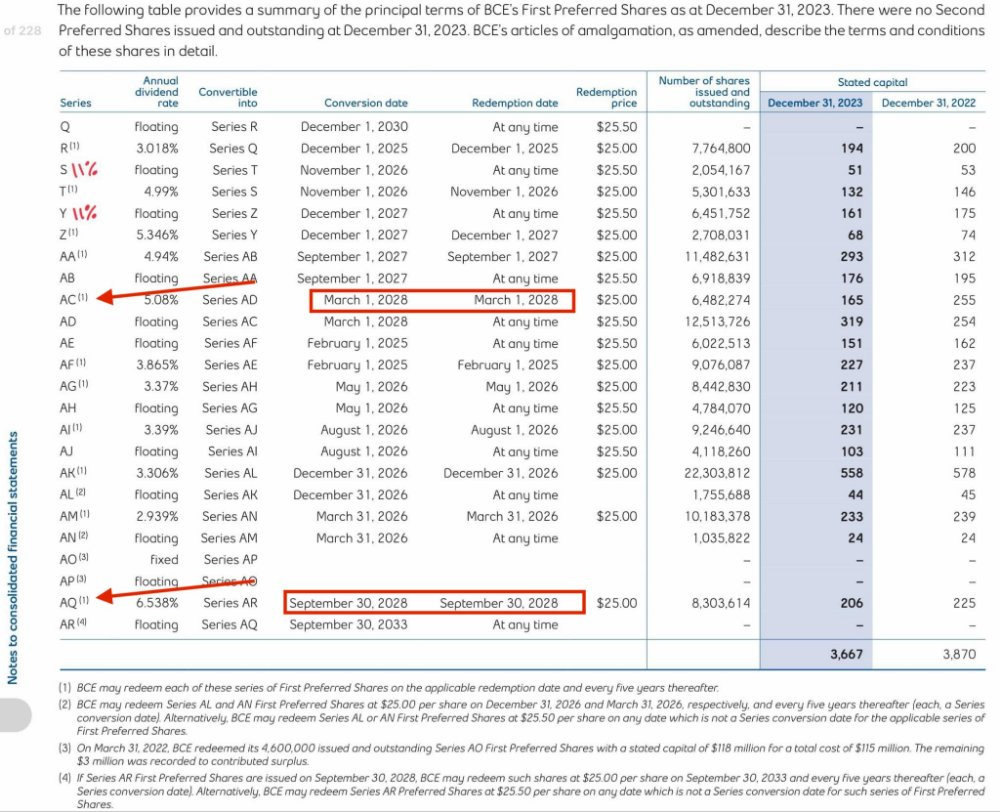

$BCE.PR.Q - BCE Inc. Cumulative Redeemable First Preferred Shares Series AQ

This is a situation to watch for. The next earnings (May 8th) of BCE 0.00%↑ will be for soon and we should surely see a cut in the dividend, but this should have no impact on the "preferred shares" which are cumulative. BCE have several series and they are not all equal.

There are only 2 series that can protect us long enough (4 years) for Bell Canada to reduce its debt before the conversion into 'floating rate' series.

We should have a lot of volatility on the "preferred shares" that will allow us to buy at good prices with more than 8% yield.

Max