Inter-Rock Minerals - Develops, markets, and distributes premium dairy feed supplements across the U.S.

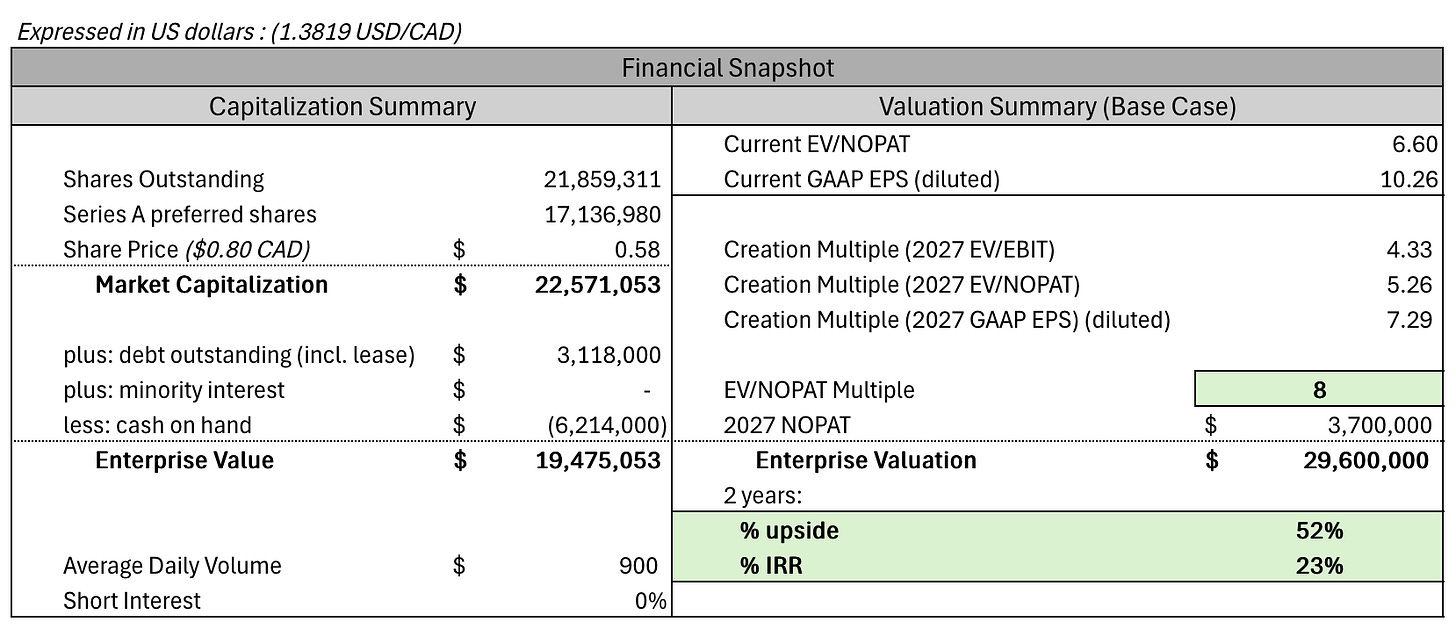

A micro-cap in a niche sector (dairy feed supplements) at less than 7x EV/NOPAT with a growth of more than 15% over the last 4 years.

Disclaimer, I am a shareholder of Inter-Rock Minerals.

EXECUTIVE SUMMARY

Inter-Rock Minerals Inc. (IRO) is a publicly-traded Canadian company with two core businesses, Papillon Agricultural Company Inc. and MIN -AD Inc. It specializes in premium dairy feed nutritional supplements and dolomite products for the animal feed industry. Given consistent revenue growth, sound liquidity, stable cash flows, positive strategic initiatives, and significant insider ownership (~70% all diluted shares). The company has demonstrated resilience amid fluctuating agricultural market conditions and is well-positioned for continued growth.

COMPANY OVERVIEW

Inter-Rock Minerals operates primarily through two subsidiaries:

Papillon Agricultural Company (86% revenue): Develops, markets, and distributes premium dairy feed supplements across the U.S. These products include proteins, prebiotics, probiotics, and clostridia control products.

MIN-AD Inc.: Engages in quarrying, processing, and marketing dolomite and clay products, serving as magnesium and calcium sources and rumen acid buffers.

Corporate History: Inter-Rock is domiciled in Canada and trades under the symbol "IRO" on the TSX Venture Exchange. Founded in 1952, it strategically focuses on animal feed nutritional supplements and specialty mineral products.

Papillon Agricultural History

2016

March 2016: Inter-Rock Minerals (via its subsidiary MIN-AD) acquires all outstanding shares of Papillon Agricultural Company. The acquisition is aimed at creating synergies in sales and marketing between MIN-AD (a dolomite producer for livestock feed) and Papillon. The integration into the MIN-AD family accelerates Papillon AG national expansion in the U.S.

2016: Papillon develops and launches BaciFlex®, a new Bacillusbased probiotic designed to support rumen health and immunity in dairy cows, particularly against pathogens like Clostridia. BaciFlex becomes one of Papillon AG flagship products, providing a natural defense against digestive disorders.

2018

(+1 Sales Manager - Mid-Atlantic)

April 2018: Papillon strengthens its sales team with the hiring of Mark Yarish as Regional Sales Manager for the Mid-Atlantic. With 25 years of experience as a dairy nutritionist at Purina, Mark brings valuable expertise to help farmers in Pennsylvania and Virginia improve feed efficiency.

2019

2019: Papillon enhances its ruminant probiotic line. The legacy product Dairyman Edge® (originally launched in 1986) is reformulated and now includes Dairyman Edge CORE—a version adapted to the challenges of newly harvested corn silage. This innovation helps maintain rumen function and milk production during forage transitions.

2020

2020: Papillon enters the beef cattle market with the launch of Cattlemen Edge®, a new nutritional supplement tailored for feedlot beef cattle. Building on its by-pass protein expertise, Papillon targets improved feed efficiency in beef operations.

August 2020: Papillon invests in its lab infrastructure, adding a NIR (Near-Infrared) Analyzer to its Painted Post, NY lab. This state-of-the-art tool enables real-time quality control of raw materials and finished products, ensuring consistency and product reliability.

2021

(+1 Sales Manager - Central Plains)

June 2021: Jorge Matos joins Papillon as Regional Sales Manager for the Central Plains (TX, OK, NM, KS, CO). With over 30 years of experience (notably at Virtus Nutrition), Jorge brings strong relationships and local insight to support herd nutrition and efficiency.

September 2021: Dr. Devan Paulus Compart is appointed as Technical Services Manager, bringing over a decade of experience in ruminant nutrition (Evonik, Land O’Lakes). Her focus includes technical support for Papillon AG product line, especially prebiotic and probiotic technologies.

2021: Papillon launches DeTerra 365™, a year-round nutritional additive designed to support digestion and wellness in cattle, further diversifying the company product offerings.

2022

(+1 Sales Manager - Mid-Atlantic)

February 9, 2022: Inter-Rock Minerals, announces the sale of its Mill Creek Dolomite business for USD 6.4 million. The decision allows Inter-Rock to focus on its core animal nutrition businesses, including MIN-AD and Papillon Agricultural Company. The transaction streamlines operations and strengthens the strategic alignment around ruminant feed solutions.

March 2022: Papillon hires Cory Doggett as Northwest Regional Sales Manager, expanding into the growing dairy regions of Idaho, Utah, Washington, and Oregon.

May 2022: Papillon announces a manufacturing partnership with Scoular to locally produce its by-pass protein blends at Scoular feed mill in Jerome, Idaho. The facility begins production in June 2022 to serve dairy producers in the Pacific Northwest, supported by Doggett sales leadership in the region.

2023

February 2023: Papillon enters a strategic technology partnership with Swiss startup Embion Technologies. Through parent company Inter-Rock, Papillon issues a convertible loan of CHF 500,000 to support the development of PREMBION®, a microbiome-modulating prebiotic made from brewery spent grains. PREMBION releases bioactive molecules that positively influence gut health in livestock. The loan is convertible into Embion equity by February 2025.

February 2023: Derek Hullett joins Papillon as Purchasing Manager, tasked with improving supply chain efficiency and ingredient sourcing amid the company expansion.

Mid-2023 (estimated): Papillon integrates automated robotic bagging equipment at its manufacturing facility. This upgrade is part of a broader effort to improve operational efficiency, safety, and consistency in product packaging. The automation allows for faster throughput and reduces labor intensity in bagging operations, supporting Papillon AG continued growth in feed additive production.

2024

(+1 Sales Manager - North Central)

Papillon launches Excelene™, a new line of customized amino acid blends for high-producing dairy cows.

July 2024: Kaitlyn Carroll is appointed National Marketing Manager, based in the Pacific Northwest. Formerly with Land O’Lakes/Purina, she is responsible for brand development and marketing strategy across Papillon AG entire product portfolio and markets.

October 2024: Marlen Schmitz is hired as North Central Regional Sales Manager, covering MN, ND, SD, and IA. With 17 years of experience in dairy nutrition, Marlen strengthens Papillon AG Midwest presence and client support.

Future Growth Region

There are approximately 7 million dairy cows in the regions served by Papillon.

In the orange region, we have 2 million, which is a 28% increase in this region alone.

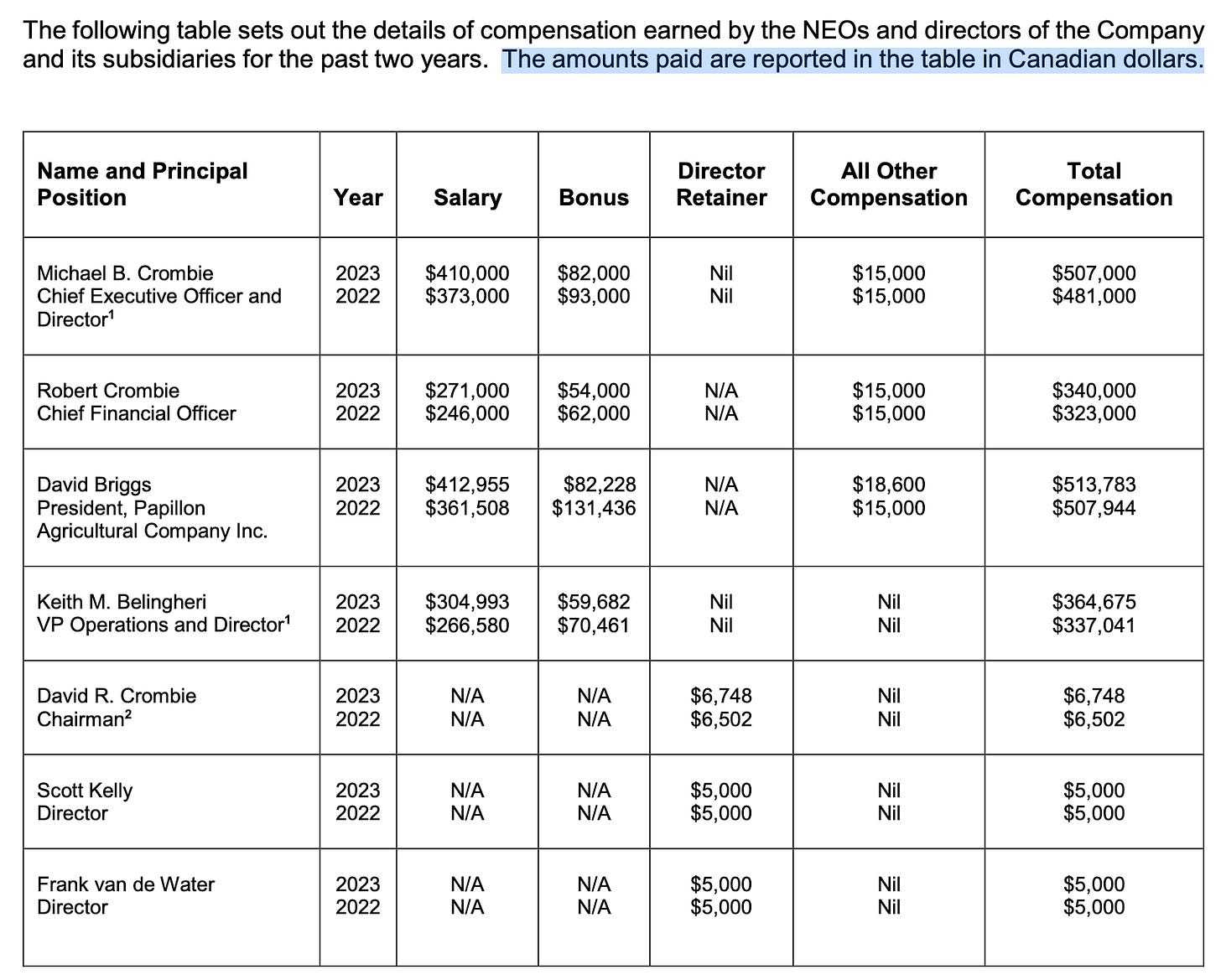

Management Overview

Inter-Rock is managed by experienced industry professionals with extensive backgrounds in agriculture, animal nutrition, and mineral processing. Corporate governance emphasizes prudent financial management and strategic operational oversight.

Michael Crombie (CEO): With Inter-Rock since 1999, he has led strategic acquisitions including MIN-AD, Mill Creek Dolomite, and Papillon. He holds a Ph.D. in Physics from the University of Toronto.

Robert Crombie (CFO): Experienced in finance and management with previous roles at Crystallex International, Dresdner Bank, and Chase Manhattan Bank.

David Crombie (Chairman): Extensive experience with Rayrock Resources, Discovery West Corp., and Minera Rayrock.

David Briggs - President, Papillon AG: Mr. Briggs has been involved in animal agriculture for over 9 years. He started his career at Papillon Agricultural Company (Easton, MD) as a product manager responsible for product positioning and marketing development.

Keith Belingheri (VP Operations): Over 40 years in mining operations, focusing on operational efficiency, safety, and environmental stewardship.

Inter-Rock has no outstanding stock options and does not have a stock option plan nor any other form of equity-based incentive plan. Which makes sense for a company that is 70% owned by the Crombie family.

INDUSTRY ANALYSIS

Inter-Rock operates within the agricultural and animal nutrition sectors, influenced by dairy and beef market dynamics. The U.S. dairy sector recently experienced volatility due to reduced global demand, notably from China, and excess domestic supply in 2023-2024. However, recent herd reductions and rising beef prices create a supportive price environment for dairy and beef producers entering 2025.

According to Feed Strategy's 2024 Top Feed Companies report, 148 animal feed manufacturers worldwide reached or exceeded 1 million metric tons of compound feed production in 2023. In total, these companies manufactured 560,933 million metric tons of compound feed last year, or 43% of the 1.29 billion metric tons of total global production estimate from Alltech's 2024 Agri-food Outlook here. 1

Key competitors:

Papillon AG specialized nutritional products and MIN-AD proprietary dolomite and clay products provide competitive differentiation.

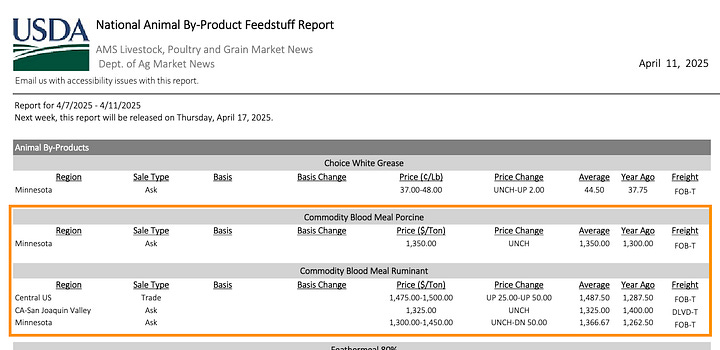

Inter-Rock touches several sectors, such as the "blood meal" which is rather concentrated in 5 major companies, and that of animal proteins which is very fragmented and very competitive.

FINANCIAL ANALYSIS

Papillon AG generates about 85% of Inter-Rock revenues. Protein products account for two-thirds of Papillon AG gross profits.

Revenue by Segment (2024 YTD – Nine Months Ended September 30)

Papillon Agricultural Company

Revenue (9 months): $72.8 million (vs. $62.3 million in 2023)

Gross Profit (9 months): $7.6 million (vs. $6.4 million in 2023)

Operating Cash Flow (before working capital changes, 9 months): $2.7 million

Comments: Strong growth in protein product sales; slightly compressed margins. As of Q2, Papillon became the exclusive distributor of MIN-AD dairy-related products across the U.S., which contributed to higher inter-company sales.

MIN-AD Inc.

Revenue (9 months): Estimated ~$6.3 million (based on Q1–Q3 data)

Gross Profit (9 months): $1.7 million (vs. $1.9 million in 2023)

Operating Cash Flow (before working capital changes, 9 months): $515,000 (vs. $708,000 in 2023)

Comments: Lower industrial sales during H1 due to scheduled plant downtime at a customer. Revenue from inter-company sales increased under the updated Papillon distribution agreement.

Series A preferred shares

The Series A preferred shares are classified as a liability in Inter-Rock financial statements, not equity, due to their mandatory dividend feature and possibly redemption terms.

Each Preferred Share... pays a non-cumulative quarterly dividend at a rate equivalent to the U.S. prime interest rate.

Current US Prime Rate 7.50% (April 2025)

Liquidity and Working capital:

Strong working capital of $10,123 million as of September 2024.

Modest total debt with disciplined capital management.

Strong cash position of $6,661 million as of September 2024.

Inter-Rock recorded more than C$3,757 million in tax losses in Canada. With more than 92% of their income in the U.S., it will be very difficult to use this amount unless they increase their Canadian income.

Investment in Embion

Embion Technologies (Embion Tech) is a Swiss startup, a spin-off from the EPFL (Swiss Federal Institute of Technology Lausanne), founded in 2016. Its mission is to "catalyze the global transition to zero waste" by converting agri-food by-products into valuable bioactive ingredients. Its flagship product, PREMBION (a registered trademark), is a next-generation prebiotic developed using a proprietary platform technology. Made from brewers' spent grains (barley malt residues from beer production), PREMBION aims to improve animal digestive health and support antibiotic-free farming, while promoting circular economy practices.

What is PREMBION and How It Works

PREMBION is a 100% natural, non-GMO hydrolysate made from brewers' grains. Embion Tech uses a patented biocatalytic hydrolysis process that breaks down plant cell walls (in this case, from spent malt fibers) to extract highly functional bioactive molecules. The process uses novel ionic polymer catalysts that are recoverable at the end of production and leave no residues in the final product.

Industrial and Commercial Advantages of PREMBION

Health and Performance Benefits: PREMBION improves gut microbiota balance, leading to better animal growth, immunity, and feed conversion efficiency. It has been proven in trials to support antibiotic-free animal farming by reducing disease incidence and enhancing overall health.

Reduction of Antibiotic Use: PREMBION provides a natural alternative to antibiotic growth promoters in livestock, addressing a major public health concern: antimicrobial resistance.

Sustainability and Waste Valorization: PREMBION is derived from one of the most abundant food industry by-products spent grains—of which 40 million tonnes are produced annually worldwide. Embion claims its process can reduce CO2 emissions by up to 80% compared to conventional ingredient production.

Regulatory and Technological Readiness: PREMBION is registered in Europe as a feed material and complies with EU and Swiss regulations. Its high thermal and chemical stability makes it compatible with current industrial feed processes.

Application Flexibility: Though initially developed for animal nutrition, the PREMBION platform can be adapted to process many plant-based waste streams into various bioactives for food, beverages, nutraceuticals, and cosmetics.

Industrial Applications

Currently, PREMBION is mainly used in animal nutrition. It can be added to livestock feed (e.g., poultry, pigs, calves) to promote gut health and performance, especially in young animals. The goal is to enable high-performing, antibiotic-free production systems.

Embion has announced commercial deployment in Europe through partnerships with major feed industry players (names undisclosed) and is conducting field trials with top global animal nutrition companies.

Financial Overview and Inter-Rock Investment

Total Funds Raised: By the end of 2022, Embion had raised approximately CHF 8 million from seed investors, Swiss public innovation grants, and a CHF 4.5 million Series A round in 2021 led by Asahi.

Startup Valuation: While exact numbers are undisclosed, Embion valuation likely reached low-to-mid eight figures in CHF following its Series A, given its commercial traction and strategic investors.

Inter-Rock Investment: In early 2023, Canadian agri-nutrition group Inter-Rock Minerals Inc. made a CHF 500,000 convertible loan to Embion, followed by a second tranche of CHF 65,000 in January 2024. The loan converts into equity upon Embion next qualifying funding round (minimum CHF 1.5 million).

This investment demonstrates Inter-Rock strategic interest in the Embion prebiotic platform, potentially for integration into its own agricultural subsidiaries such as Papillon Agricultural. We can certainly hope to see Inter-Rock sign an exclusive for North America, or be the leading supplier in the coming years.

If Embion becomes a huge global success with steady revenue, it will create value for Inter-rock investment in the long term. This remains hypothetical, but we can see it as a source of long-term value.

In accordance with the terms of the loan agreement, in October 2024, the loans were converted to 113,000 shares of Embion, representing a 4.6% ownership interest. The investment in Embion shares was written down by $435,000 to its fair value of $200,000 at December 31, 2024 due to an observable transaction in the form of a recent equity financing, reflecting current market conditions and the estimated fair value of the Company’s investment in Embion shares. Embion is small company developing a novel catalytic process to break down waste biomass, for example, brewer’s grains. The process can be adapted to convert certain carbohydrates that can be utilized by bacteria in the gastrointestinal tracts of animals.

Source: 2024-MDA

INVESTMENT THESIS AND CATALYSTS

Inter-Rock Minerals trades at an attractive valuation given its consistent profitability, insider ownership (70%), and strong financial condition. Since 2021, they have quickly focused on expanding into several regions. We can see this with the hiring of a new "Sales Manager" in 2021, 2023 and 2024. And the sale of Mill Creek in 2022 to focus Papillon AG growth. Their organic product growth will be the most important catalyst in the next years.

They remain a little known distributor in this area. There are still many markets to conquer in the coming years.

What are the reasons why it will succeed in taking more market share?

Good products2 and their brand new product "Excelene Pass", which has a very good performance/ price ratio.

It is clear that Inter-Rock has implemented an effective sales and marketing strategy since 2021. Kaitlyn Carroll recent arrival in marketing is great news for long-term growth. We can see that they are very active online on their blog and websites in the livestock and veterinary sector.

This type of sponsored post3 is a very good marketing technique, especially on niche sites that have a small audience but target exactly the clientele they are looking to reach.

The benefits of blended proteins.4

Blended proteins can provide the same rumen-undegraded protein (RUP) and amino acids that nutritionists traditionally turn to blood meal for, while providing improved product consistency and pricing insulation compared to single ingredient options.

“With a blended protein, you’re not putting all your eggs in one basket,” said Clayton Stoffel, Technical Service Manager at Papillon Agricultural Company. “A blend offers protection from drastic price fluctuations like we’ve seen with blood meal in the recent months.”

For example, since 2017 blood meal has averaged around $1,000/ton and ranged between $600 and $2,500/ton. During the same time, a comparable blended protein averaged around $850/ton, ranging between $550 and $1500/ton (Figure 1). This is due to the diversification of blends using a variety of high-quality animal rendered byproducts like blood meal, pork meat and bone meal, as well as hydrolyzed feather meal with plant proteins and rumen-protected amino acids. Blended proteins also allow nutritionists to target specific amino acid profiles beyond lysine and histidine typically associated with blood meal.

Balancing For Performance and Price

Though it shows a similar steady increase in price over time, price volatility was reduced by around 15% compared to commodity blood meal.5

The US market for dairy supplements and feed minerals is highly competitive and fragmented. According to various industry studies, the North American market for feed additives exceeds USD 10 billion annually, of which several billion are specific to ruminants.

Others catalysts:

Partner with a Canadian distributor or increase sales.

Possible family buyout of the remaining 30% float.

Potential special dividend from significant cash holdings ($4 million USD).

In the years to come, Inter-Rock could be bought by a big group.

RISKS AND MITIGANTS

Key risks:

Commodity price volatility.

The price charged by Papillion AG fluctuates with the price of other types of ingredients such as "blood meal"

Dairy industry dependence.

If milk prices fall, producers will have less money to spend on protein. There is a need to monitor the evolution of milk prices in the US.

Competitive pressures.

Mitigants:

Diversified product offerings.

The Excelene pass takes more market share.

Operational efficiencies.

Strong financial discipline.

VALUATION

In the past, Inter-Rock was concentrated in the northern United States. With the arrival of several "sales managers" in different regions and their collaboration for the west. This led to an average income growth of 15% between 2021 and 2024. I am convinced that thanks to their marketing and sales strategy, we can still expect a growth of 10-15% for the next 2 years.

Inter-Rock revenues are greatly affected by the cyclical price of milk. I cannot predict the future price of milk, but the increase in sales should limit the difficult times. With their huge pile of money, we should be able to finance future growth and face any short-term challenge (black swan).

Since 2016, the average ROIC has reached 15% (without adjustment), even during difficult times they have managed to make profits. If we adjust the working capital to exclude $4 million in cash, we take out the sale of Mill Creek and the automation of some tasks. We could see an increase in margins and a ROIC has more than 20%.

When analyzing the ROCE, we observe an average of 16% since 2016.

In the past, we were averaging about 2.5x the asset turnover rate. Since 2022 and the sale of Mill Creek, we are between 3.5x and 4x. Fixed asset turnover has increased from 10x to more than 25x.

A net working capital that represents less than 6% of the income and a capitalization capital on the income of less than 3.50%. These qualities please me very much.

The Q4 2024 report has not yet been published, but if we end 2024 with a NOPAT of 3 million. And that our expansion for the coming years is taking place. We should reach over 3.7 million. With an EV/NOPAT multiple of 8, we obtain a upside of 57% and an IRR of 25% for 2027.

I would not go into 5 or 10 year estimates with a DCF. But in the long term (10 years), this management seems very competent, with a good track record. I would not be surprised to see that growth will remain above 9% for several years.

CONCLUSION

Inter-Rock Minerals Inc. is well-managed, financially solid, strategically positioned, and competitively advantaged within the agricultural nutrition market. Given the company proven management, insider ownership, financial strength, and growth potential. Their new product is selling well and will continue to grow significantly in the coming years, with reasonable valuation.

Max

https://www.agrimarketing.com/s/152337

https://www.papillon-ag.com/products/

https://www.bovinevetonline.com/news/education/whats-missing-ingredient-transitioning-dairy-cows

https://www.papillon-ag.com/feeding-gemini-proteins-improves-herd-income-over-feed-costs-iofc/

https://www.papillon-ag.com/blood-meal-or-soy-protein-dairy-producers-shouldnt-limit-themselves-to-those-choices/