Knight Therapeutics, the Roll-Up Pharma - English 🇬🇧

Presentation of a serial acquirer in the specialized pharmaceutical sector.

$GUD.TO, $KHTRF (OTC)

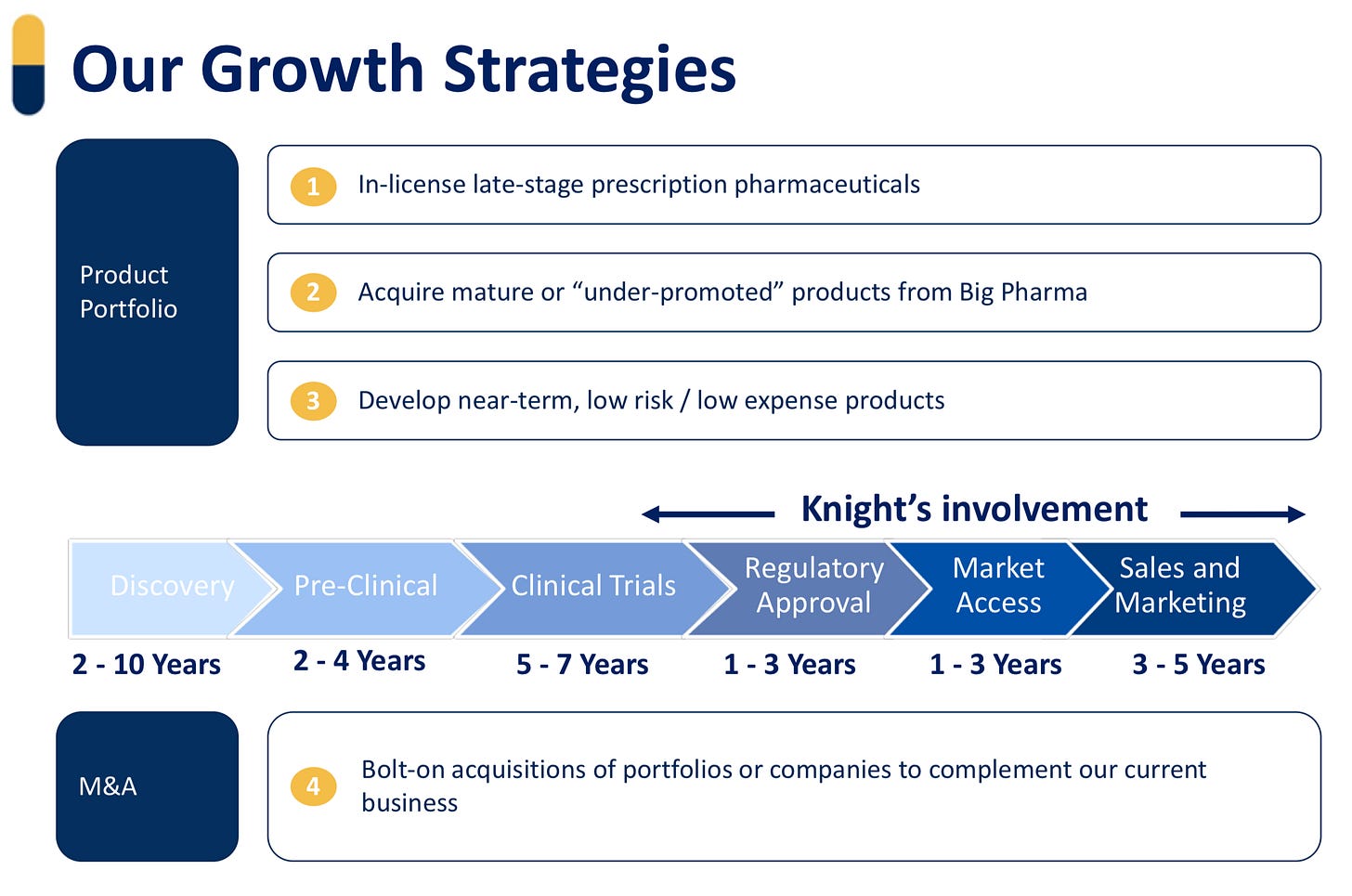

Knight Therapeutics makes money by acquiring marketing rights for specialty drugs in countries deemed too small to be worthwhile for multinational drug manufacturers. This basically means all countries outside the USA, Europe, Japan and China. Canada, for example, accounts for 2% of the global pharmaceutical market, according to government statistics. To gain access, drug manufacturers must obtain approval from the Health Canada review agency, then obtain price approval from another board and negotiate with each provincial government to determine what each will pay for the drugs. Even for a rubber-stamp approval of a U.S.-approved drug. Food & Drug Administration, reformatting documents to Health Canada's requirements costs over $500,000 (Canadian) and takes about six months. Companies then face a further two years or so to get through the layers of bureaucracy.

Potential catalysts

Several product launches over the next two years.

An improvement in Knight's activities in Latin America recent negative impacts of COVID-19.

Inflation slows in Latin America.

Endo's post-bankruptcy restructuring plan.1 2

If Endo sells part of its portfolio, then Knight will be a serious and quick buyer for their Canadian portfolio.

Buyback (23% in 3 years) 3

Any investor who has followed the Canadian specialty pharmaceutical industry over the past ten years has probably picked up a consistent theme. Specifically, Canadian specialty pharmaceuticals have gone through a period where the majority of companies have subscribed to the "multiple accretion/financial arbitrage" model of acquiring existing assets and performing lifecycle management. We believe that this model, which we define as the "Roll Up" pharmaceutical model, often fails to deliver sustainability. While this model can be lucrative in a bullish pharmaceutical market, it's a strategy that quickly comes under pressure when the cycle reverses, the cost of capital rises, the pace of transactions slows and company valuations contract. When the cycle reverses, investors are exposed to significant downside risk.

We believe that the successful specialty pharmaceutical model, which we define as the "full-cycle" pharmaceutical model, requires :

ability to generate volume-driven growth

responsible use of leverage

solid management

disciplined use of capital

Typically, in the full-cycle pharmaceutical model, companies will focus on specialized therapeutic niches where the vast majority of prescribing physicians can be approached by a small, specialized sales force detailing products early in their lifecycle. In this model, companies benefit from volume-driven organic growth and high operating leverage, while continuing to develop their product portfolio. Mr. Jonathan Goodman, Chairman and founder of Knights, wrote the book on the full-cycle pharmaceutical model, as evidenced by his success at Paladin Labs. This model, with few exceptions, has rarely been replicated in Canada after Paladin. We believe that Mr. Goodman, along with his former Paladin team, including Ms. Sakhia and Ms. Khouri, are well on the way to replicating this model again with Knight Therapeutics.4

History

A Paladin Labs spin-off that got off to a bad start.

Looking at the Knight Therapeutics story over the past 10 years, it doesn't look pretty. Early post-spin-off investors paid a generous valuation in the hope that Mr. Goodman would recreate Paladin Lab version 2. Nevertheless, this doesn't happen in a matter of months. With low interest rates at the end of 2009, the market was very competitive and expensive for license acquisition.

If you go back in time, you'll also see several "proxy fights" with another majority shareholder. All this to say that these were tumultuous years for Knight Therapeutics.

Knight Therapeutics' low valuation is due to more than 7 years without a major license acquisition, with a weak pipeline. Knight Therapeutics was on the lookout for good acquisitions without ever unearthing anything. Until 2019, when they made their acquisition in Latin America (Grupo Biotoscana).

If you look at the sector in general, several companies have gone bankrupt in the last 10 years because they used too much debt or paid too much for their acquisition. There's a lot of competition in this market.

As Knight is the only public specialty pharmaceutical company with significant operations in Latin America, there is a lack of directly comparable companies.

No adjustment, data from Koyfin

After 10 years, Knight Therapeutics remains solid with a robust pipeline and a handsome balance sheet, they have around 160 million in cash. With high interest rates, there will be less competition for license acquisitions.

Not to mention that management holds over 23% of the outstanding shares.

Revenues

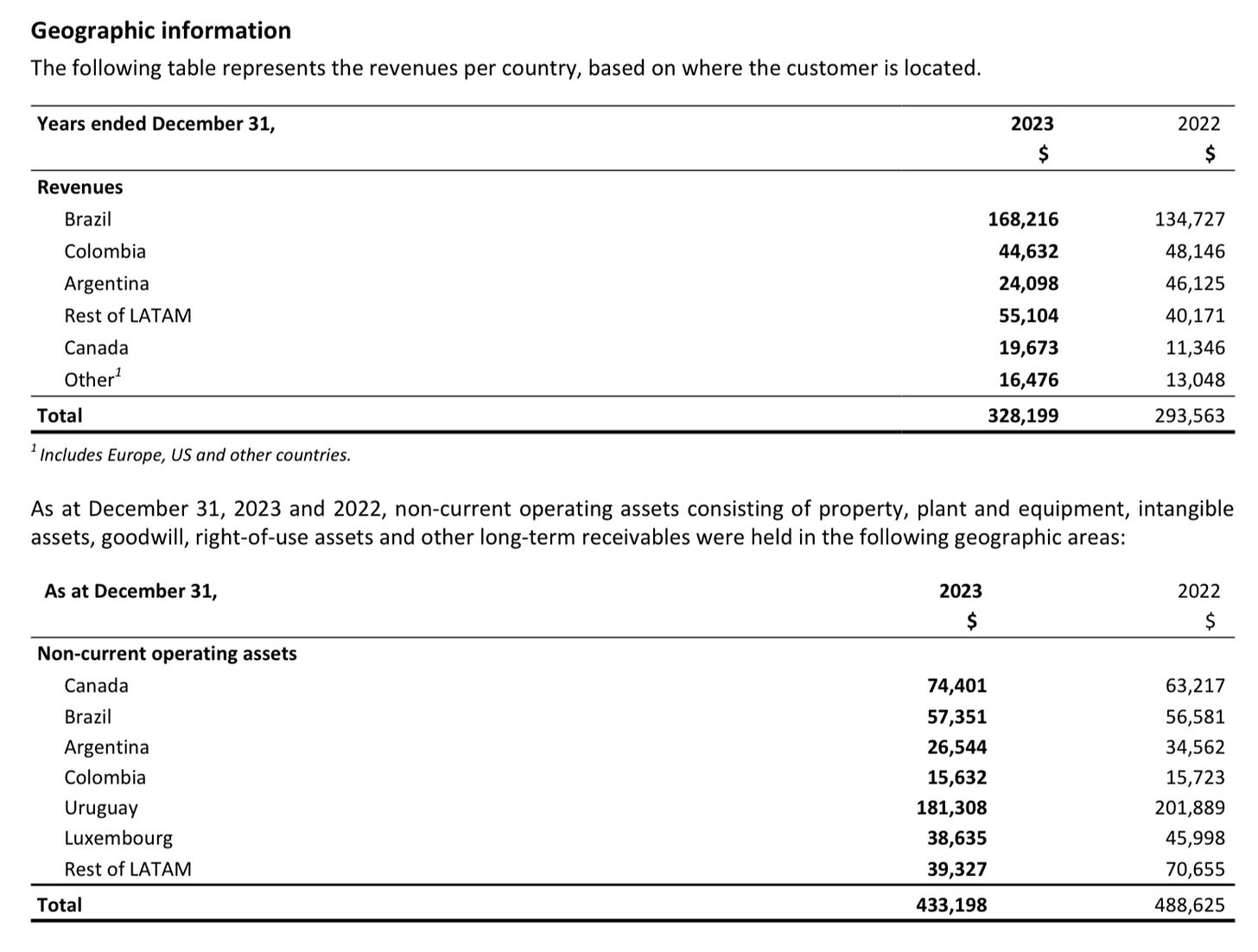

Since the purchase of the Biotoscana Group (GBT) in 2019, over 80% of Knight's revenues come from Latin America.

Products Pipeline

In the coming months, Knight will be launching new products in Canada, which will increase revenues from Canada and be more stable over time.

Strong Pipeline in early launch or various stages of development: We have assembled a pipeline of 17 products across our territories expected to be launched by 2028. These products are projected to generate over $120 million in peak revenues. We have advanced the pipeline with the submission of 8 of these products for regulatory approval in at least one country.

Source: 2023-Q4

Evaluation

2024-2025 estimation

Risks

Risk of not finding a good acquisition.

Clinical and regulatory risks. Like other specialist pharmaceutical companies, the company's products must undergo extensive clinical testing and obtain regulatory approval before launch.

Risk of default on Knight's lending operations, partially offset by the secured nature of the loans granted by product rights and other assets.

Max

Disclaimer I am a shareholder of Knigh Therapeutics.

https://www.reuters.com/business/healthcare-pharmaceuticals/drugmaker-endo-reaches-465-mln-bankruptcy-settlement-with-us-government-2024-02-29/

https://www.inquirer.com/business/endo-international-plc-opioid-lawsuit-settlement-20240229.html

Raymond James Research 2018